south carolina inheritance tax 2019

If they are married the spouse may be able to leave everything to each other without paying any. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

How Is Alimony Calculated In South Carolina Child Support Laws Calculate Ch Child Support C Child Support Quotes Child Support Laws Child Support Payments

Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax.

. Find out whats changed in 2019 for inheritance law. Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax. Federal Estate Tax.

South Carolina residents do not need to worry about a state estate or inheritance tax. South Carolina has no estate tax for decedents dying on or after January 1 2005. A married couple is exempt from paying estate taxes if they do not have children.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Even though there is no South Carolina estate tax the federal estate tax might still apply to you. Has the highest exemption level at 568 million.

Governor Henry McMaster recently signed a bill allowing for the creation of a statewide filing. As well as how to collect life insurance pay on death. 8 00 9 TAX on excess withdrawals from Catastrophe Savings.

The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. - 38 - - - 2020-09-14 - 2020-09-15 040742 - 12. South Carolina Inheritance Law.

South Carolina Inheritance Law. We invite you to come in and talk with one of. South Carolina Inheritance Law.

Of the six states with inheritance taxes Nebraska has. 7 TAX on Lump Sum Distribution attach SC4972. The requirements for a valid will change from state to state but are pretty.

7 00 8 TAX on Active Trade or Business Income attach I-335. Iowa has a separate inheritance tax on transfers to others than lineal ascendants and descendants. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning.

2019 the New York estate tax exemption amount will be the same as the. The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand. The federal estate tax exemption is 117 million in 2021.

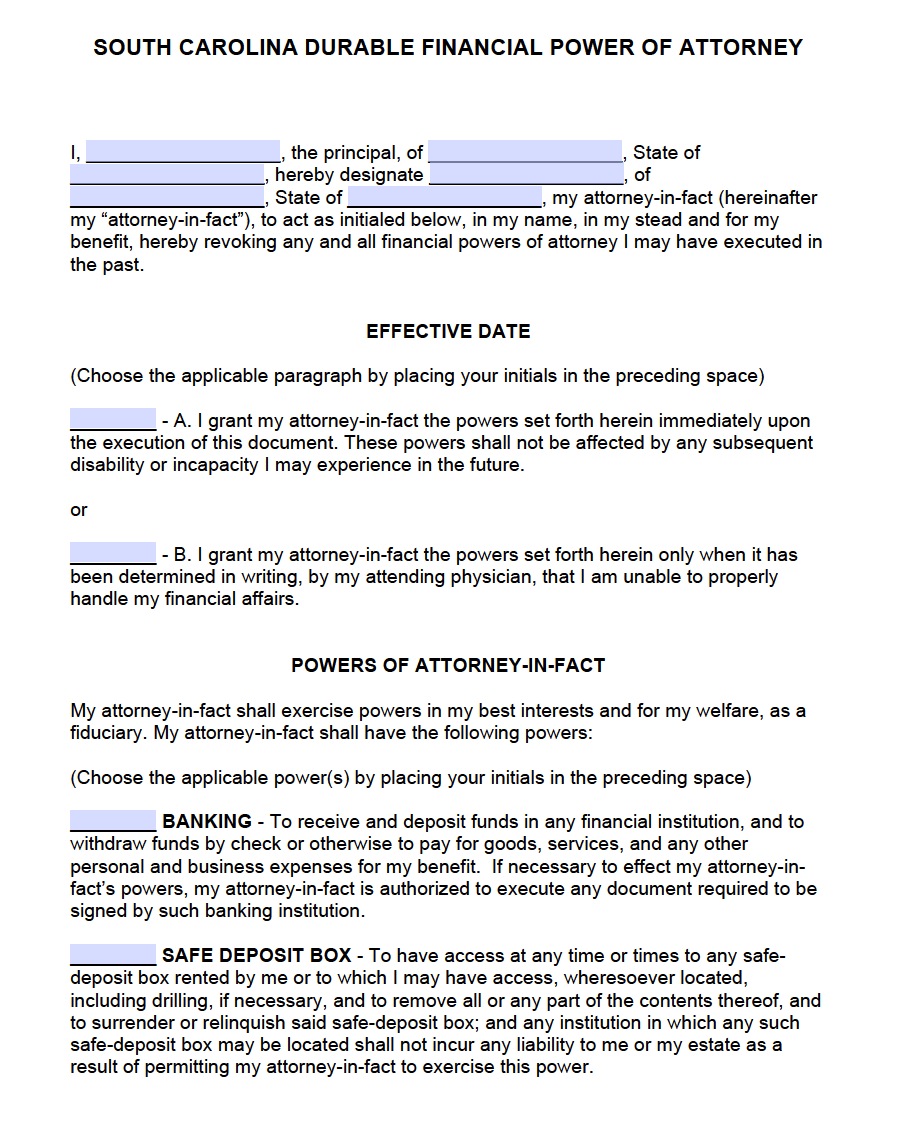

Minnesota has an estate tax for any assets owned over 2700000 in 2019. However according to some. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

It has a progressive scale of up to 40. November 2019 3 october 2019 2 september 2019 3 august 2019 4 july 2019 2 Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. As well as how to collect life insurance pay on death.

Massachusetts has the lowest exemption level at 1 million and DC. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. Currently South Carolina does not impose an estate tax but other states do.

Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. As well as how to collect life insurance pay on death. In January 2013 Congress set the estate tax exemption at 5000000.

Info about South Carolina probate courts South Carolina estate taxes South Carolina death tax. This means that if you have 3000000 when you die you will get taxed on the 300000 over the. Get Access to the Largest Online Library of Legal Forms for Any State.

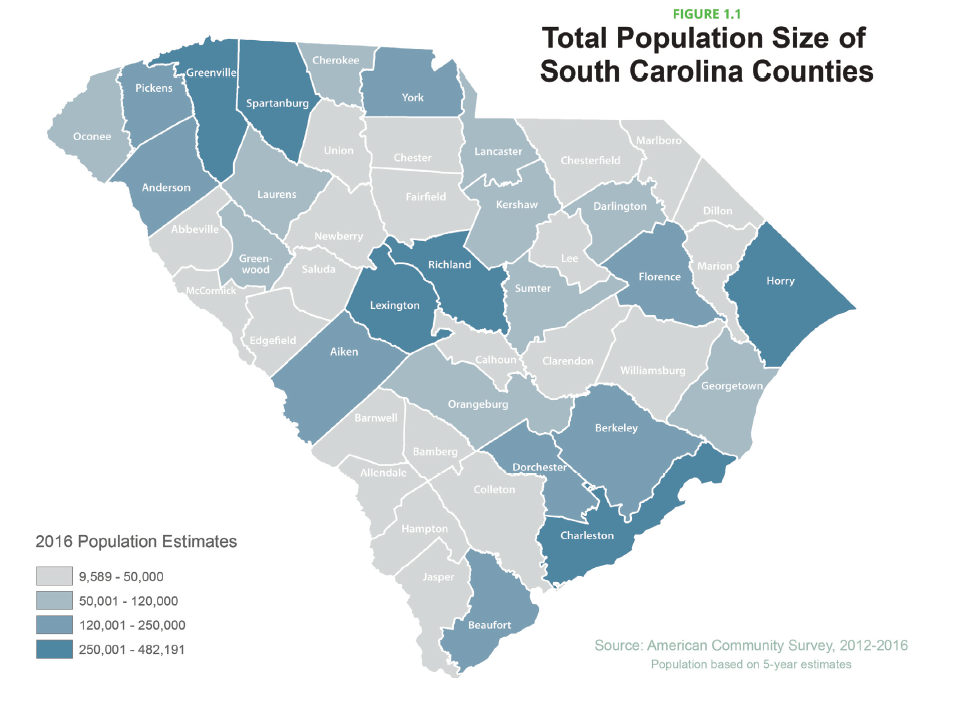

See How South Carolina S Counties Are Growing And Shrinking Gem Mcdowell Law 843 284 1021 Estate Business Law Local

12 Best Places To Live In South Carolina

Free South Carolina Power Of Attorney Forms Pdf Templates

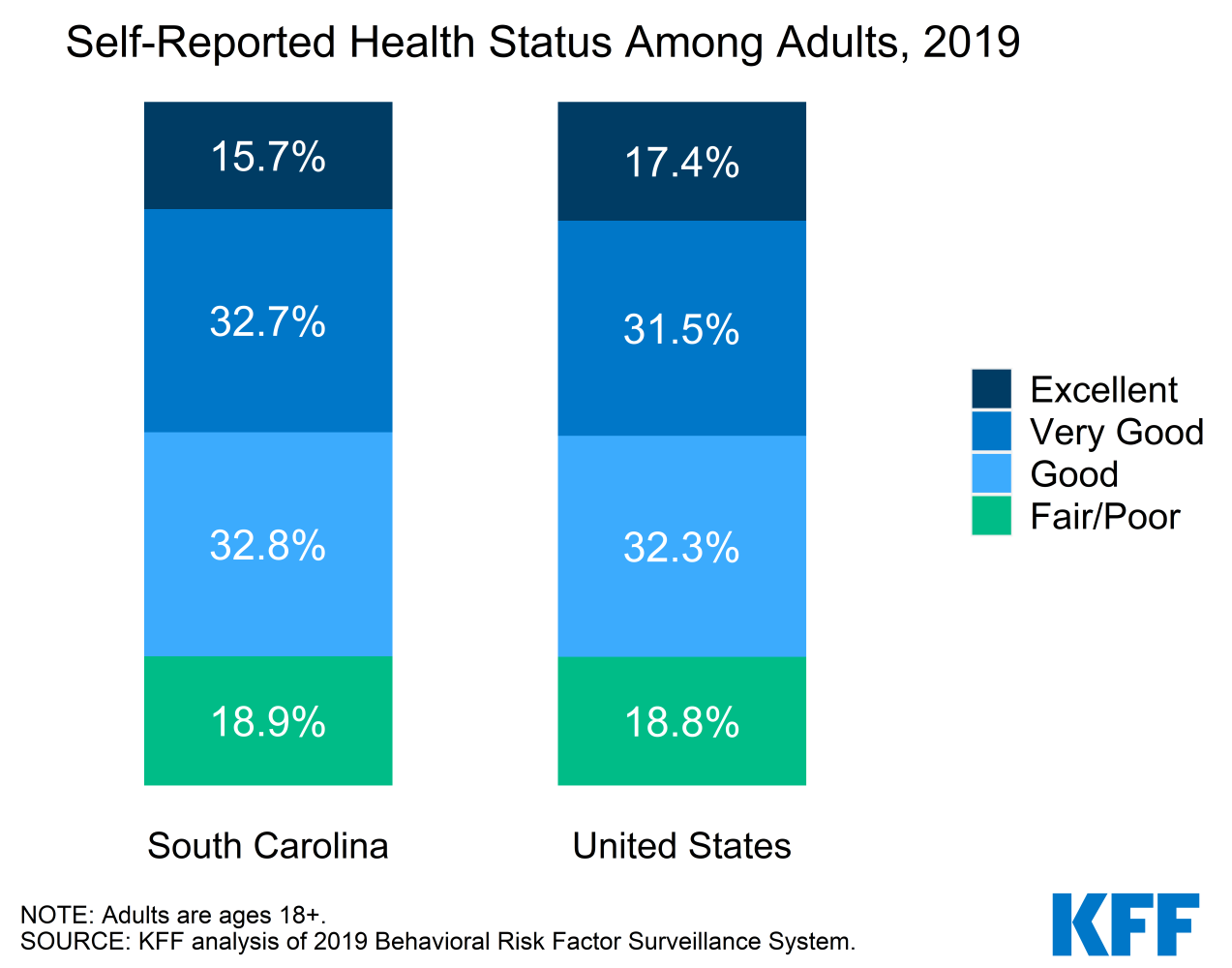

Election 2020 State Health Care Snapshots South Carolina Kff

The Pros And Cons Of Retiring In South Carolina

South Carolina Income Tax Calculator Smartasset

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

2022 Best Places To Live In South Carolina Niche

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Home Abbeville County South Carolina

Complete E File Your 2021 2022 South Carolina State Return

Ultimate Guide To Understanding South Carolina Property Taxes

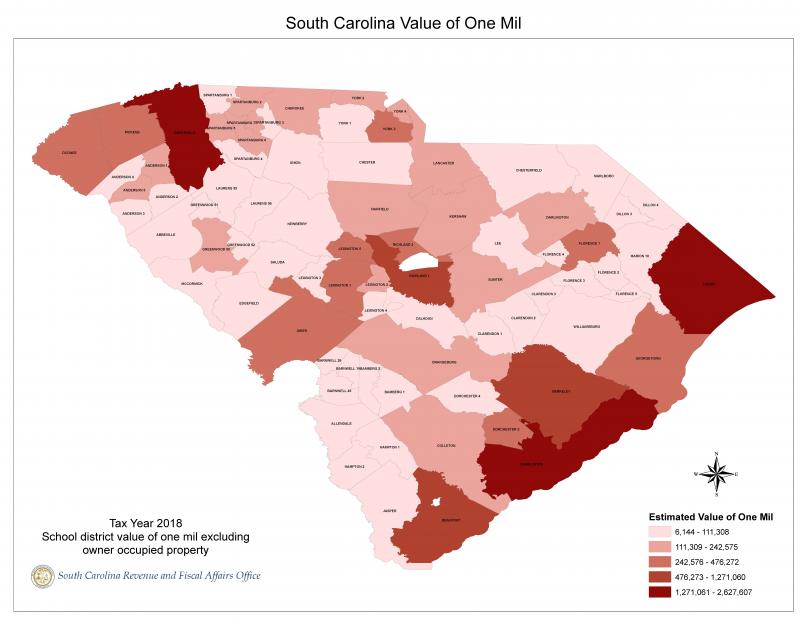

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

The True Cost Of Living In South Carolina

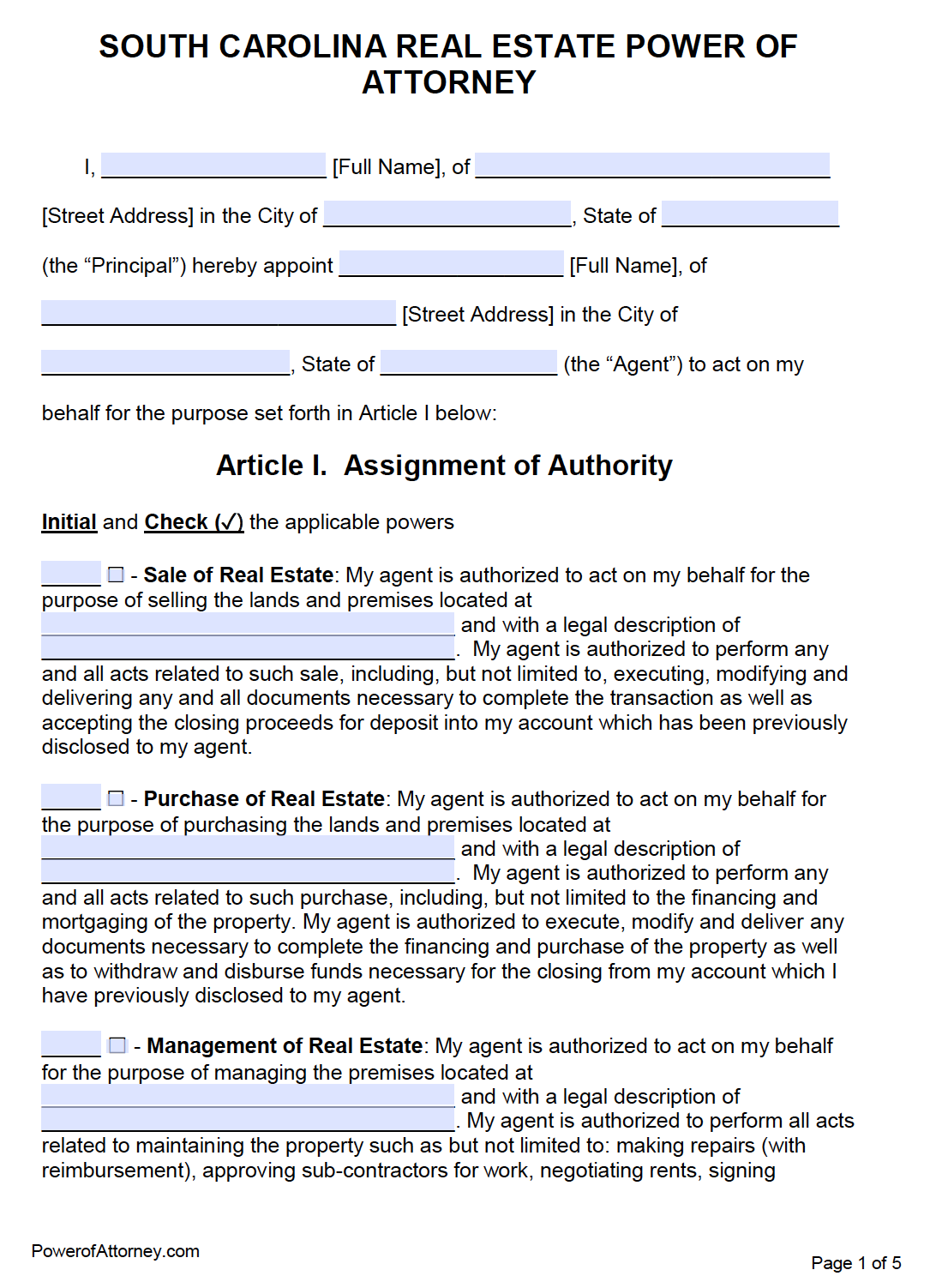

Free Real Estate Power Of Attorney South Carolina Form Pdf Word

South Carolina And The 19th Amendment U S National Park Service

South Carolina Health At A Glance 2018 Live Healthy State Health Assessment Report Demographics Scdhec